Risk Management

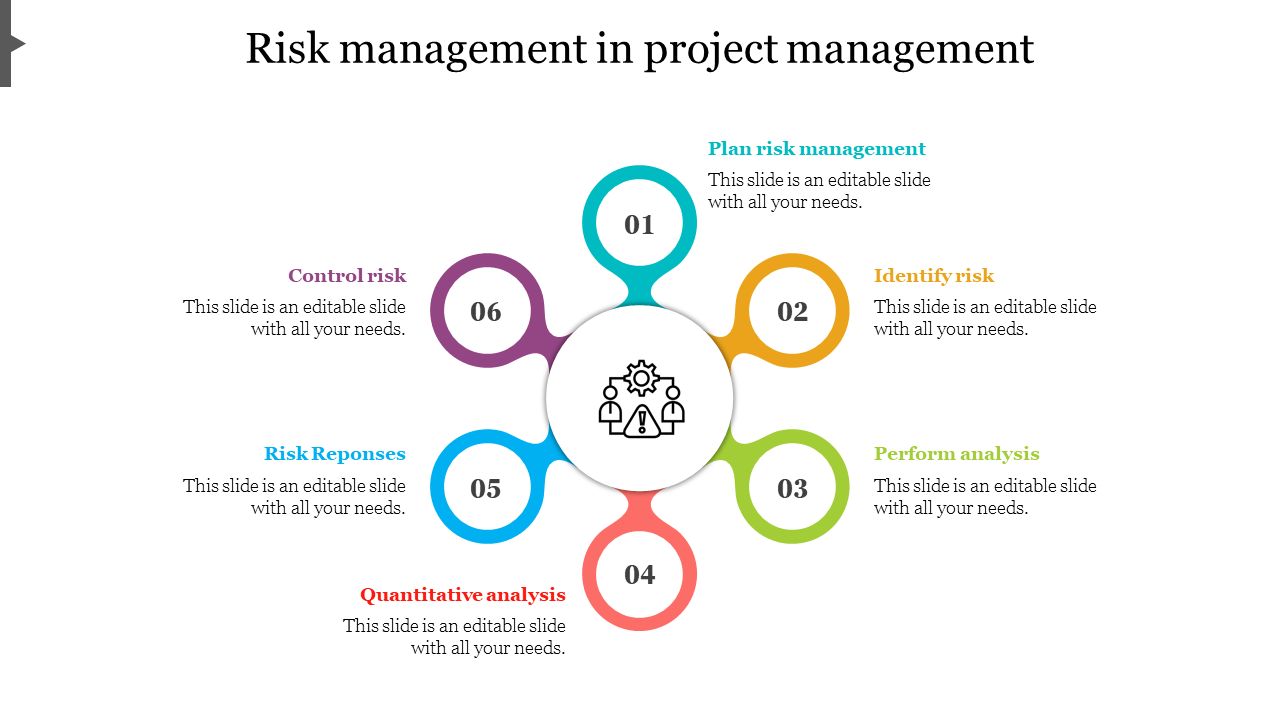

Risk Management Risk management in project management is the process of identifying, assessing, mitigating, and monitoring potential risks or uncertainties that could impact a project’s objectives, timeline, and budget. Effectively managing risks is critical to ensure a project’s success. key …

Overview

Risk Management

Risk management in project management is the process of identifying, assessing, mitigating, and monitoring potential risks or uncertainties that could impact a project’s objectives, timeline, and budget. Effectively managing risks is critical to ensure a project’s success.

key aspects of risk project management:

- Risk Identification: The first step in risk management involves identifying all potential risks that could affect the project. This includes both internal and external risks.

- Risk Assessment: Once identified, risks are assessed to determine their likelihood and impact on the project. This information is used to prioritize risks.

- Risk Analysis: In-depth analysis may be required for high-priority risks. This analysis involves understanding the root causes of risks and their potential consequences.

- Risk Register: A risk register is a document that records all identified risks, their characteristics, assessment details, and mitigation plans. It serves as a central repository for risk information.

- Risk Mitigation: Risk mitigation involves developing strategies to reduce the likelihood and impact of identified risks. Strategies may include risk avoidance, risk reduction, risk transfer, or risk acceptance.

- Risk Monitoring and Control: Throughout the project, risks are continuously monitored to detect changes in risk factors or new risks. Risk control involves executing the risk response plans and taking corrective actions as necessary.

- Contingency Plans: In some cases, contingency plans are developed to address potential risks if they materialize. These are predefined actions that will be taken if specific risks occur.

- Risk Ownership: Each risk should have an assigned owner who is responsible for managing and mitigating the risk.

- Positive Risks (Opportunities): Not all risks are negative. Positive risks, also known as opportunities, can provide potential benefits to a project. They should be identified and exploited.

- Risk Tolerance: Risk tolerance refers to the organization’s or project stakeholders’ willingness to accept a certain level of risk. Understanding risk tolerance helps guide risk management decisions.

more:

- Risk Reporting: Regular reporting on the status of risks, including their potential impact and mitigation efforts, is important for project stakeholders and decision-makers.

- Risk Communication: Effective communication is essential in risk management. It ensures that project team members, stakeholders, and sponsors are aware of risks and their potential impact.

- Qualitative vs. Quantitative Risk Analysis: Qualitative analysis involves assessing risks based on subjective judgment, while quantitative analysis uses numerical data to assess risks in a more quantitative manner.

- Risk Response Strategies: Common response strategies include avoidance (eliminating the risk), mitigation (reducing the risk’s impact or likelihood), transfer (shifting the risk to a third party, like insurance), and acceptance (acknowledging the risk without active mitigation).

- Lessons Learned: After a project is completed, it’s important to review the effectiveness of risk management and document lessons learned.

- This information can inform future projects.

Effective risk management in project management can help minimize the negative impact of unexpected events,

keep the project on track, and increase the likelihood of successful project completion.

It is an essential part of the overall project management process.

more concepts and considerations related to risk management i:

- Risk Categories: Risks can be categorized based on their nature, such as technical risks, market risks, financial risks, or legal risks.

- Categorization can help in a more organized approach to risk assessment.

- Monte Carlo Simulation: This is a quantitative risk analysis technique that uses computer algorithms to model and simulate various risk scenarios, providing a range of possible project outcomes.

- Residual Risk: After applying risk mitigation measures, some level of risk might still remain. This is called residual risk, and it’s important to manage and monitor even after mitigation efforts.

- Risk Appetite: Risk appetite defines how much risk an organization or project is willing to tolerate.

- It’s usually set by senior management and influences risk management decisions.

- Risk Assessment Tools: Various tools and techniques are available to assess and prioritize risks, including risk matrices, decision trees, and SWOT analysis.

And:

- Risk Registers: A risk register is a dynamic document that is regularly updated throughout the project.

- It provides a snapshot of the project’s current risk profile.

- Sensitivity Analysis: Sensitivity analysis involves testing how variations in certain factors, like cost estimates or timeframes, impact the overall project’s sensitivity to risk.

- Risk Audit: A risk audit is a review of the risk management process to ensure it’s being carried out effectively and in alignment with project goals.

- Risk-Adjusted Return on Investment (ROI): In financial project management, risk-adjusted ROI accounts for the potential risks and uncertainties in a project, providing a more realistic view of its profitability.

- External Risks: External risks are factors outside of the project team’s control, such as changes in regulations, economic conditions, or natural disasters. These can have a significant impact on the project.

- Contractual Risk: In projects involving contracts or partnerships, contractual risk relates to the potential risks and liabilities outlined in the agreements. Managing these risks is essential to protect the project’s interests.

- Risk Reserves: Risk reserves, often referred to as contingency or management reserves, are funds or time set aside to address unforeseen risks or changes. These are an important part of project budget and schedule planning.

- Risk Reviews: Regular risk reviews are meetings or discussions within the project team to assess the status of risks, evaluate their impact, and discuss mitigation strategies.

- Risk Heat Maps: Risk heat maps are visual representations of risks, often color-coded to indicate their severity and priority.

- Risks in Agile Projects: Agile methodologies, like Scrum, incorporate risk management through iterative development, frequent reviews, and adaptability to changes.

Effective risk management is a continuous process that evolves as the project progresses.

It is crucial to ensure that the project stays on track and delivers its intended outcomes while minimizing potential negative impacts.

Curriculum

- 1 Section

- 1 Lesson

- 1 Hour